Stock Options 101

Consider joining a startup offering stock options…or considering offering them to your employees? Not all startups use stock options as an incentive for employees and officers, but if you are thinking about the possibility, here are a few basic questions you should ask and consider before jumping in.

Questions to ask:

- Do I trust this team? Is it the right company?

- What is my percentage ownership?

- What is the market rate for salary and equity compensation?

- Do I need a lawyer or accountant to review my option grant?

- What is the vesting schedule?

- What are the tax implications?

Discussion

1. The Team

As with any investment, the capabilities of the team are crucial. Have they done this before? Do they have a track record of turning startups into profitable companies? Are they trustworthy? The team must feel they can trust one another and those at the helm.

2. Ownership

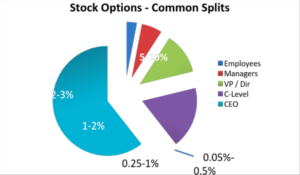

Most companies split up ownership when they take on their first outside money. At that time a stock option pool will be set up as an incentive for executives and employees. The pool is frequently between 10% and 20% of the company. Here is a table of common splits within that pool:

3. Value

The value of the stock options has to be established by an outside third party according to IRS rule 403(b). In some instances, the company will establish the value of the stock, but it has to reflect fair market value. If a company has had a financing transaction with an outside party, the economics of the deal can be used to set a value stake in the ground.

4. Tax and Legal Help

If you are receiving a stock option you really should talk to your tax advisor about how it can impact your tax situation. Those offering options should encourage recipients to seek appropriate advice. There are a lot of potential tax implications for the employee, especially if they are receiving ISO (incentive stock options) versus NSO (Non-statutory Options). ISO’s have some very favorable tax implications, but they should understand long-term capital gain versus ordinary income.

5. Vesting

Most options vest over a period of time. Vesting means employees actually receive the right to the option. The company may grant options, but if it vests over 3 to 5 years, the recipient really doesn’t have the right to exercise those options unless they stay at the company over the entire vesting period. Common vesting schedules are 3-year vesting where you earn 1/3 per year. Often a “cliff” is employed, where the recipient doesn’t vest in anything unless they remain with the company for 1 year and then they vest a full year’s worth of options, with ongoing monthly vesting thereafter.

6. Taxes

ISO’s are not taxable to the employee until the options are sold. NSOs are compensation to the employee or consultant when granted. ISO’s can be exercised as they vest and that will begin the long-term capital gains clock ticking, but it is often hard for employees to exercise the option and actually pay for the stock, so often they are exercised when a company has a liquidity event. The resulting tax implication then is a function of being ordinary income instead of capital gains. Consider carefully whether the options are tied to milestones. If they are, the options then become contingent compensation and tax consequences are incurred as the options vest. Consider whether options can be exercised early. This starts the long-term gain clock ticking early and the recipient vests in the stock over time. They can also make an IRS 83b elections, which allows for some significant tax savings. Again, however, it is recommended that all parties talk to their tax advisor.

Conclusion

Stock options are a great incentive for employees in companies that are:

- Growing

- Have the possibility of stock values becoming significant

- A likely liquidity event in the future

Equity compensation encourages each employee to act like an owner if it is managed properly by using them to align everyone’s interests in the future of the company.