Business Crisis Management: 8 Strategies for Leading Businesses Through Crisis

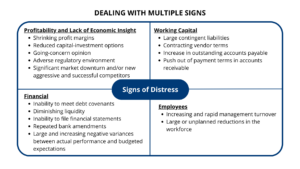

Managing an organization in crisis requires clear analysis, quick action, and a plan. Companies that have moved into a business crisis over a long period of time might fail to see that they are in distress. Like a frog placed in water which is slowly brought to a boil, it is difficult to see danger that is building up slowly. The faster you acknowledge that there is a problem, the more time you have to fix it before it gets worse. The more distressed the situation is, the less time there is to analyze. One of three critical requirements to succeed is diagnosing the current and future business situation, developing a structured performance management plan and implementation to ensure needed improvements.

“The process for turning around troubled companies is easy to understand and challenging to implement”

1. Analyze the business

The objective of the analysis stage is to determine the severity of the situation and whether it can be turned around. Questions you should ask include: Is the business viable? Can it survive? Are there sufficient resources to turnaround the organization?

Operational strategies to include are: increasing revenue, reducing costs, selling and redeploying assets, and establishing competitive repositioning. Strategic initiatives include adopting sound corporate and business crisis strategies and tactics and setting specific goals and objectives.

2. Stop the bleeding

At this stage, the objective is to gain control of the situation, particularly the cash, and establish breakeven. Centralize the cash management function to ensure control. If you stop the cash bleed, you enable the entity to survive. Time is your enemy. Protect asset value by demonstrating that the business is viable and in transition. You must raise cash immediately but be careful to not take on “bad” debt making it more difficult or expensive and puts the organization at great risk.

“Businesses fail because of mismanagement. Sometimes it is denial, sometimes negligence, but it always results in loss”

3. Develop a plan

As a leader, continuously monitor, adjust, and even reformulate your plan as new information emerges. Be ready and willing to pivot, and prepare for the inevitable “one step forward/two steps back” setbacks. Establish a communications routine and stick with it, even if there’s nothing to say other than “nothing new at the moment.” When progress has been made, even if it’s minor, be sure to share it so that people don’t despair. Communication should be two-way: listen to what your team is saying, and not saying. The information and insights they have may surprise you.

Turnaround or growth, it’s getting your people focused on the goal that is still the job of leadership.

4. Focus on cash

A successful turnaround really comes down to one thing, focusing on cash and cash returns. That means bringing a business back to its basic element of success. Is it generating cash or burning it? And, even more specifically, which investments in the business are generating or burning cash. A realistic forward-looking cash flow projection highlighting the main sources and drainage of cash and the time horizon available with realistic best, likely, and worst-case scenario options. The cash flow is the key tool to managing, targeting, planning, and controlling the implementation of the crisis plan.

5. Build traction

Build traction for change with quick wins. The tendency of most leaders is to put all of their focus and resources into three or four big bets to turn a company around. That can be a high-risk approach. Even if big bets are sometimes necessary, they take a lot of time and effort and they don’t always pay off. In addition to going after big bets, managers should focus on getting a series of quick wins to gain traction within the organization. Such quick wins can be cost-focused, cutting off demand for some external service they don’t need, or they could be policy focused, such as introducing a more stringent policy on travel and meal expenses. Not only do such moves improve the bottom line, but they also generate support among employees. You are likely to find that employees across the organization are supportive of change. They work hard if you give them a reason to stand up and be positive about the company. When you quickly take real action, and when those actions affect change, you send a powerful message.

6. Build your team

Find and retain talented people beyond the leadership team, there are two types of people.

Institutional knowledge

First are those that have institutional knowledge. They may not be your top performers, but they know all the ins and outs of the company—and are vital to understanding the impact of potential changes on the business. Many times they are the disgruntled ones, unhappy with the company’s performance.

Uncomfortable truth

Second, you need people who are willing to point out uncomfortable truths. A turnaround is also a real opportunity to find the next level of talent in an organization.

7. Track Progress

The final stage of business crisis management is putting all the work into action. With a clear vision, the right resources, and motivation, the execution becomes easier. But this stage is also extremely critical as leaders often have a lot of lessons to learn. Once the plan is put into action, leaders have to carefully track progress, learn from their mistakes and identify and build on their strengths.

8. Emerging

After a crisis has abated, you should expect new processes, strategies, and cultures to emerge. Adjusting both emotionally and cognitively may take a while. Once the most immediate and challenging aspects of a crisis are under control, think about the kinds of crises that your organization is likely to experience in the future.

Amplēo Can Help

If your or your client’s business is going through a financial crisis, contact Amplēo for business crisis management help. Our consultants are trained to analyze the situation, develop a plan of action, and execute quickly.