A Macro Look at the Current Economic and Market Outlook

As an investor or stakeholder, you are likely monitoring current economic trends in the United States and around the world. Understanding the market is important, as stock market performance can directly impact the value of company shares. Stock prices can also affect a company’s ability to raise capital or attract investment, and stock market trends serve as indicators of broader economic conditions.

In summary, it’s important to monitor stock market conditions and analyze economic trends because they directly impact various aspects of your company’s financial health, strategic decisions, and stakeholder relations.

At the Amplēo 2023 CFO and Growth Summit, renowned economist Martin Atkins shared his team’s insights on how the market has been performing over the last few years and what they expected to see in the future. His forecast has been in line with what we are seeing in economic conditions in early 2024.

Our objective in this article is to share some of those observations to help you make more informed decisions about your organization moving forward. First, we’ll discuss fixed-income markets. Then, we’ll dive into what’s team has seen in the market, if the economic situation is normalizing, and what we can look forward to in the future.

Fixed-Income Markets Observations

Fixed-income markets are a class of assets and securities that pay out a set level of cash flows to investors, typically in the form of fixed interest or dividends. The fixed-income market plays a crucial role in the global financial system by providing a means for businesses to raise capital and for investors to allocate their funds across a spectrum of risk and return.

What drives the fixed-income market? Macro trends. Whereas micro trends focus on small-scale, localized, or specific phenomena, macro trends highlight larger, broader, and more global phenomena.

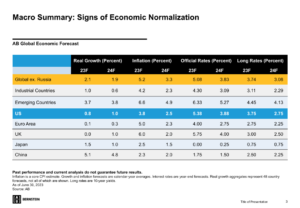

As Martin reviewed the macro summary of the global economy, he pointed out that real growth is currently slow but positive. He also observed that inflation is high but coming down, and interest rates are coming off their peaks.

In this graphic, you can see that the US (in blue) is having a little more success in combating inflation than other countries. As a consequence, the pathway to lower rates is closer and a little more certain in the States. One negative Martin sees for the US, however, is lower long-term growth.

What do these macro trends indicate? Atkin’s team is seeing signs of normalization within the economy.

Signs of Economic Normalization

In 2022, markets were negative across the board because inflation proved itself to be both higher and more persistent than anticipated. Consequently, there was a massive policy response in the form of rising rates.

What Martin and his team observed in 2023 was a total reversal of 2022. Things were positive across the board because the markets indicated that inflation was moving behind us and that investors were going to get through this without a large recession.

If you look at the last three years, everything is positive. Based on this economic data, it appears that 2022 was an aberration.

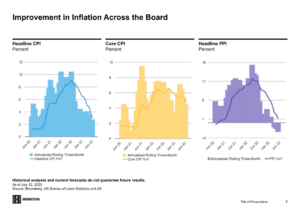

In this graphic, inflation is shown through three measures: headline CPI, core CPI, and headline PPI. Within the headline producer inflation, Martin points out that inflation peaked in the fall of 2022.

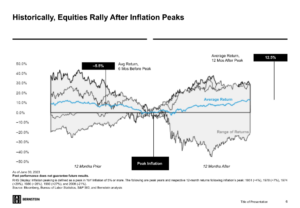

As Atkin’s economists went back and looked at every time of high inflation in the US and looked at what markets did prior to and after peak inflation, markets, in general, rallied after peak inflation. What this current rally tells us is that we’ve likely seen peak inflation and the worst is behind us. However, it won’t be all smooth sailing moving forward.

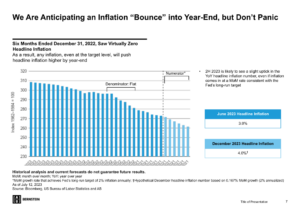

Inflation is calculated by year-over-year inflation, which includes a denominator and numerator effect. Inflation was set to rise at the end of 2023. Below is a technical calculation for year-over-year inflation. Month-over-month inflation is likely to continue to fall.

Many people doubt the data of inflation and feel it is a conspiracy of the government. However, inflationary measurements are individually based. That means there is no such thing as national inflation, as we all have different consumption paths. But the key to the way the government measures data is that it does so with a consistent calculation. The consistency of this calculation allows us to view market and economic trends. The trends are what economists are interested in rather than the absolute values of data.

What about the recession everyone was talking about in 2022? In 2022, the market indicated that the policy set by the Federal Reserve Board (FRB) (which was to raise rates fast and far) would lead to an inevitable recession in the United States. The FRB was fine with this as they have two mandates: price stability and full employment. Most of the time, these two mandates don’t conflict too much with one another. However, in times of very high inflation, the FRB decided to make it their number one priority to bring inflation down, relegating full employment to a lower priority. Due to these policy responses, many were expecting a recession.

As Martin observed what truly happened in 2022 and 2023, you can see that the Goldilocks Outcome—i.e., when inflation goes back to its long-term target, which, by the FRB’ standard, is 2 percent per annum—is highly likely. A Goldilocks economy includes consistent economic growth but not so much growth that inflation rises by too much. This helps prevent a recession. In this phase of the economic cycle, investing is typically ideal. Martin discussed what he believes the future will hold later in this article.

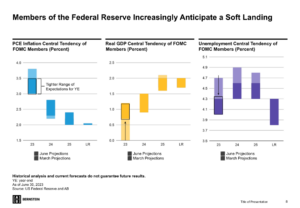

What does the FRB anticipate? As you can see in this graph, the FRB expects a soft landing. Projections for inflation are on the left (in blue), projections for growth are in the middle (in yellow), and unemployment projections are on the right (in purple). Based on these projections, the FRB believes inflation will come down more quickly, the real GDP will not be affected very much, and employment will stabilize.

What Trends Do Economists See Based on Federal Reserve Projections?

In 2022, the market saw “good news” as “bad news.” Why was that? Every time an employment feed came through and showed that employment was robust in the US, it led to fears that inflation would continue at high levels, which led many to believe that interest rates would go up further. So good news was viewed as bad news.

In 2023, good news was good news. So when economists received impressions that employment was healthy, the market saw that as “good news” because the market was considering whether there would be a recession or not. Currently, employment data that is strong does not indicate a recession.

The Power of the US Consumer

While economists are seeing trends that a recession is unlikely, some trends are less favorable. The US consumer is hugely powerful and drives the US economy, which drives the world economy. This is an important component for understanding trends. As Atkin’s team considered current trends, they are seeing some weakening in that power.

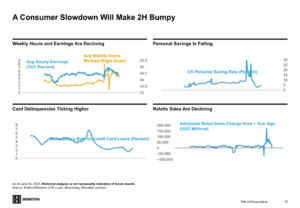

Savings rates grew massively in 2023 when the government wrote checks to stimulate the economy, and consumers began taking vacations and spending that money. Now economists are seeing retail sales coming down. From the data on this graphic, Martin pointed out that card payment delinquencies are rising but from an exceedingly low base. These trends show that the base for the consumer is very strong. Martin believes this will create a little bit more noise in the economy over the next six months or so.

The Federal Deficit Outlook

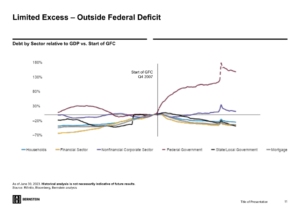

Debt is the great financial crisis. You can see that, leading into the great financial crisis, all sectors of the economy were becoming more and more leveraged. This is not the case today. In fact, there has been a greater leveraging across the private sector. The financial sector has delivered, and state and local governments have delivered. Mortgages have come down in the US. There has been a lot of prudence in the private sector; however, not so much by Uncle Sam.

Economic Conclusions

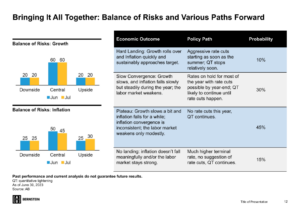

What is the conclusion of all of this? On this graph, you can see various economic outcomes and their probabilities. Economists always weigh probabilities for the economy. The economic outcome outliers are 1) a hard landing and 2) no landing at all (we just cruise through and get inflation under control, and growth continues on a normal trend). However, it’s unusual for the economy to go to extremes. The economy tends to stay in the middle because there are many counter-balancing forces.

So, what is the middle of these probabilities? The middle is the things Martin described. It’s a slightly weakened job market, below-trend economic growth, and inflation falling (albeit a little slowly).

What does that mean to interest rates, which will really affect people? It means that official rates are unlikely to ease in 2024.

Based on our discussion thus far, let’s discuss how Martin believes the future will look.

Looking to the Future

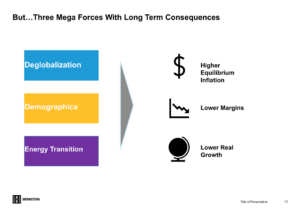

For a horizon that is five, 10, or 20 years out, economists consider three mega forces: globalization, demographics, and energy transition. Together, these three mega forces create higher equilibrium inflation than we’ve had in the past, lower profitability, and impact growth negatively (not negative growth—just lower real growth). Let’s explore these in turn.

Deglobalization

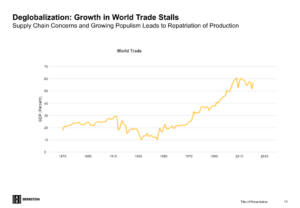

What is globalization? This chart shows world trade as a percent of global GDP. You can see that following WWII, it had a very fast, upward trajectory. As of today, however, it has plateaued.

This is likely due to two big forces: First, the pandemic revealed to us that supply chains can be vulnerable. So, economists began to have less confidence in the idea of globalization. Second, there has been a rise in what economics refers to as populism, which is nations choosing to act more and more in their own self-interest rather than in the global interest. As a consequence, Atkin’s team has seen some patriatian production in world trade. Martin, as a Keynesian economist, believes this benefits all of us rather than serving as an antiproductive force.

Demographics

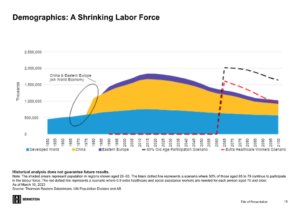

The second force is demographics. This graphic shows participants in the labor force. First, you can see that the labor force peaked in about 2010 as our population began getting older. Second, it shows a great surge of labor input flows, which began in the mid-70s when China and Eastern Europe (after the dissolution of the Soviet Union) began participating in the global economy.

As area populations age, the workforce is lost. That is antiproductive, and that causes scenarios: an upside and downside case. The black dotted case is the upside case where more people over the age of 50 participate in the labor market. That would be a favorable trend. An unfavorable trend is the red dotted line, which shows that more of the productive labor starts to look after the older generation rather than work. Again, this is a real antiproductive issue with no solution.

Energy Transition

There is a significant trend toward climate change mitigation. That means that we’re moving from an infrastructure of energy that was supported by fossil fuels to an infrastructure of energy that’s supported by renewables. No matter your stance on this move, it’s considered antiproductive because nations currently have a very useful infrastructure that works today that we’re replacing with another.

These three forces—globalization, demographics, and energy transition—lead to adverse consequences for growth and, therefore, the appreciation of assets over time. So what does the future hold?

Economic Outlook and Its Effect on Investment Decisions

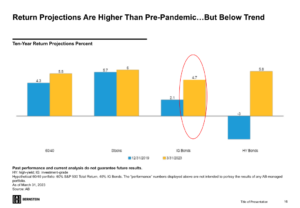

As Atkin’s team considered trends starting with 2019 (pre-pandemic) and comparing them to 2023, they compared 10-year projections for returns for different asset classes: stocks, investment grade bonds, leveraged companies, high-yield bonds, and a moderately allocated stock/bond portfolio (60/40).

What are the conclusions here? The big conclusion is that the return to investment-grade bonds has significantly improved as a result of rising rates. The outlook for stocks 6 percent per annum mid-single digits is well below trend. And it’s well below long-term trends, which are about 10 percent per annum. Why is that? It’s because of the three mega forces that are restricting growth and, therefore, tightening profitability and returns to stocks.

This chart reflects the equity risk premium between the return to stocks and the return to the risk-free assets of government bonds.

In reviewing IG bonds (circled in red), the equity risk premium has narrowed very significantly. In other words, you, as an investor, are being paid less to take risks because the equity risk premium is narrow.

As economists have gone back and looked at all periods where the equity risk premium is narrow, they can conclude that that’s good for the bond investor but poor for the stock investor (tends to be more volatile and less absolute return). Economists can also conclude that it’s good for certain alternatives.

Advice Roadmap

What is Atkin’s advice? He is advising his clients that if they are modestly allocated, they have to make some decisions. They have to decide if they are satisfied with a lower outcome, mid-single digits, 5 percent per annum, or if they want more.

If they want more, they have to take more equity risk, which is not going to be hugely rewarding. This will require turning to alternative sources of return and accepting some of the drawbacks: illiquidity, uncertainty, and lack of transparency.

The general conclusion is this for investors and money managers: Move out of traditional assets—they are less rewarding than they were.

Speak with One of Our Amazing Fractional CFOs

An Amplēo fractional CFO can help you eliminate ambiguity in investing, enhance accountability and transparency, and implement a targeted financial strategy to propel your ambitious revenue objectives. Instead of investing significant time and resources in searching for a full-time resource—which can be time-consuming and costly with potential missteps—consider engaging a CFO with decades of experience on a part-time basis. Contact us to speak to a CFO today!

About Amplēo Partner Martin Atkin, Economist

This article was taken from a session conducted by Martin Atkin, economist at Bernstein Private Wealth Management, at Ampleo’s 2023 CFO & Growth Summit.